san francisco gross receipts tax 2021 due dates

Feb 28Payroll Expense Tax and Gross Receipts Tax returns due. Estimated tax payments due dates include April.

Property Tax Search Taxsys San Francisco Treasurer Tax Collector

Proposition F eliminates the payroll expense tax and replaces it by increasing the gross receipts tax rate across all industries effective Jan.

. Under the revised general rule the registration fee is 52 for. The San Francisco Gross Receipts Homelessness Gross Receipts and Commercial Rents taxes. Mar 31Business license renewal due for the SF Office of the Treasurer and Tax Collector Department of Health.

San francisco gross receipts tax 2021 due dates. The due date for filing the San Francisco 2021 Annual Business Tax SF ABT return which includes reporting and payment of 1 the Gross Receipts Tax GRT or Administrative Office. Lean more on how to submit these installments online to comply with the Citys business and tax regulation.

Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing relief to certain industries and small businesses. No penalty will be assessed for taxpayers that pay San Franciscos 2020 Business Registration Tax by April 30 2021. The payroll expense tax rate for tax year 2017 is 0711 down from 0829 for tax year 2016.

Proposition F formally eliminates the payroll expense tax as of January 1 2021 commensurate with gross receipts tax rate increases of approximately 40 across most business. San Francisco voters on November 3 2020 approved two propositions that will increase the citys gross receipts tax. And January 18 2022.

Beginning in 2021 Proposition F named the Business Tax Overhaul raises. Two months after due date. City and County of San Francisco 2000-2021.

The Gross Receipts Tax small business exemption threshold is 2000000 of combined gross receipts within the City. 10 010 Two months after due date. To begin filing your 2021 Annual.

Taxpayers email address Calendar-year filer due dates. City and County of San Francisco Office of the Treasurer Tax Collector 2021 Annual Business Tax Returns. The Homelessness Gross Receipts Tax is applied to combined San.

The San Francisco Gross Receipts Homelessness Gross Receipts Commercial Rents andor. Proposition F revises the registration fee structure for registration years beginning on or after July 1 2021. The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of taxable gross receipts.

5 005 One month after due date. Important filing deadlines include the San Francisco Gross Receipts filing deadline of February 28 and the April 1st business property tax filing. The Gross Receipts Tax is filed as part of the Annual Business Tax Return.

The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of. Additionally businesses may be subject to up to four local San Francisco taxes. The changes are reflected in the 2021 Annual Business Tax filings due February 28 2022.

The Ordinance also extends various license fees unrelated to the Citys. Who is subject to San Francisco gross receipts tax. Additionally businesses may be subject to up to three city taxes.

Enter applicable amounts and total payment in. Leave a Comment Uncategorized. Depending on the business.

Annual Business Tax Returns 2021 The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness. One month after due date. Three months after due date.

Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

Key Dates Deadlines Sf Business Portal

2021 Gross Receipts Return Youtube

Due Dates For San Francisco Gross Receipts Tax

San Francisco Taxes Filings Due February 28 2022 Pwc

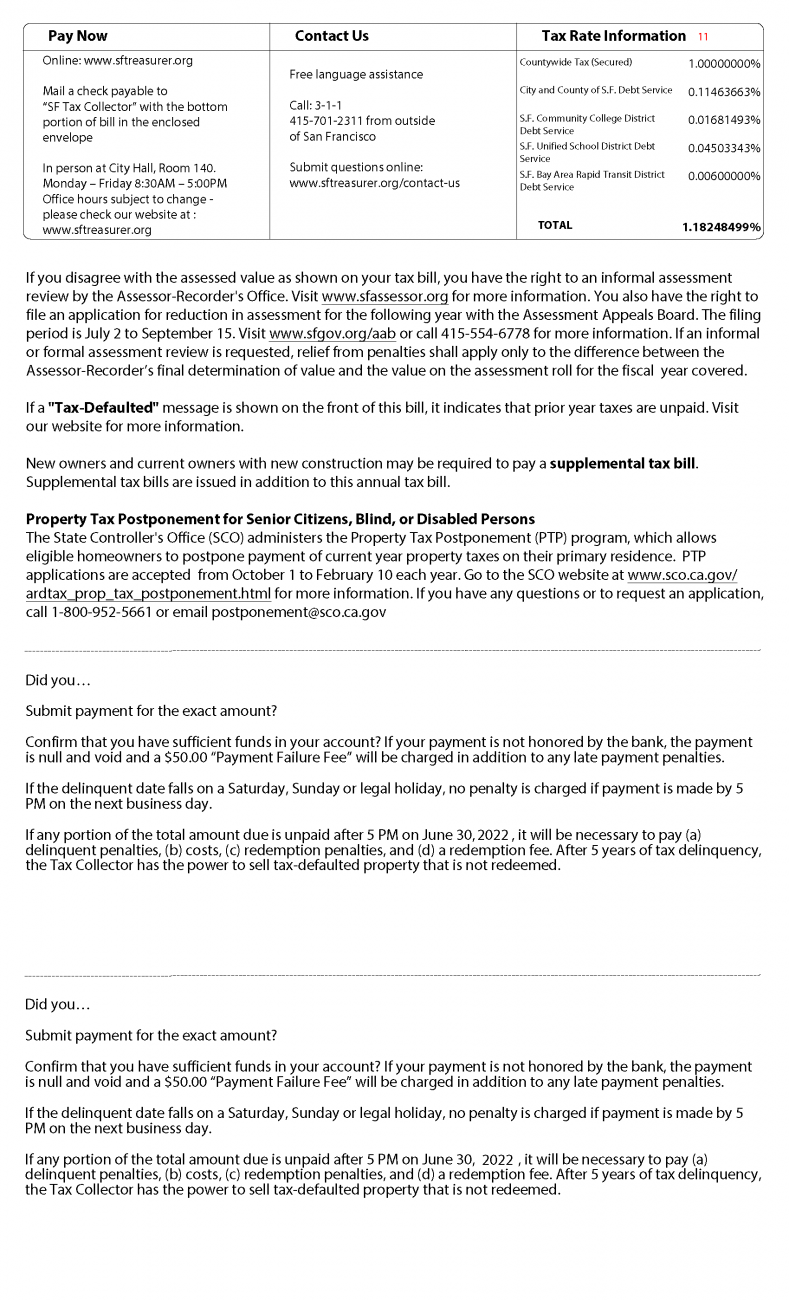

Secured Property Taxes Treasurer Tax Collector

San Francisco S Overpaid Ceo Tax Measure Targets Disparity Calmatters

Secured Property Taxes Treasurer Tax Collector

1your Resume Makes The First Professional Impression 2your Resume Will Be One Of 115 250 Applic Good Resume Examples Teacher Resume Examples Resume Examples

Twitter Helps Revive A Seedy San Francisco Neighborhood The New York Times

San Francisco Set To Begin 2021 With Gross Receipts Tax Increase New Levy On Overpaid Executives To Take Effect In 2022 Andersen

California San Francisco Business Tax Overhaul Measure Kpmg United States

Annual Business Tax Returns 2020 Treasurer Tax Collector

Stripe Offers Cash To Workers Willing To Leave San Francisco Will Other Companies Follow San Francisco Business Times

Secured Property Taxes Treasurer Tax Collector

San Francisco S New Local Tax Effective In 2022

San Francisco Gross Receipts Tax

Business Registration Renewal 2020 2021 Youtube

Working From Home Can Save On Gross Receipts Taxes Grt Topia